On a yearly basis, the school together with Hudson Area Society School Base are pleased to give more than 100 scholarships and grants considering economic you need since the better just like the quality founded scholarships and grants.There are even exterior grant potential that you may qualify having.

Fund

Academic loans give a technique pupils so you can borrow cash to assist pay for college. The second financing applications come:

- Government Lead Student LoanPlease make sure that you have obtained your own school funding award email notice in advance of obtaining your own Federal Head Education loan.

- Government Direct Along with Financing (Mother or father Weight for Student Scholar)

iontuition

- What is iontuition? iontuition is a webpage giving the information and you can products your need to make the most of one’s higher education. Just like the a student regarding Hudson Area Neighborhood College or university, you have got totally free usage of iontuition provided because the a courtesy from the i3 Class LLC!

- Stay on finest of the college loans. iontuition’s interactive dash and you can fees calculator tell you everything you need to know about handling and you can trying to repay the loans, as well as total financing balance, current payment per month, mortgage status, appeal accrued and you may installment options.

- Replace your monetary degree. Student loans and personal finance would be confusing. Which have iontuition, you have access to every piece of information needed to efficiently deal with your own money. Know about budgeting, college loans, identity theft & fraud and a lot more.

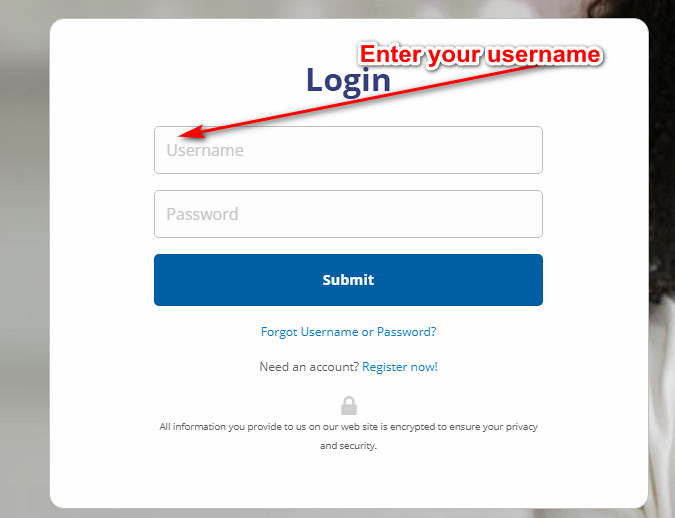

- How do i do my 100 % free account? Register for your totally free iontuition membership on behalf of Hudson Valley Area School in the iontuition. Stick to the instructions to own hooking up their iontuition account into school.

- Start off:iontuitionCounselors of iontution are hit within step 1-855-456-2656.

Federal Head Education loan

Paid Constraints for brand new Consumers Notice The latest Student loan Individuals: People the debtor can become ineligible for additional Head Subsidized Funds and may treat their subsidy into in earlier times borrowed Direct Paid Loans. This can exist in the event that several months when the brand new debtor features gotten paid finance exceeds 150 percent of your own authored amount of its instructional program. Information on Backed Restrictions for new Borrowers (PDF)

Eligibility to have Government Lead Student loans is set for everybody children that have recorded a beneficial FAFSA (Free Software to possess Government College student Aid). Pupils evaluate the qualification and you can undertake financing fund they wish to obtain through WIReD.

- Be subscribed to and sustain no less than 1 / 2 of-big date enrollment (half dozen knowledge-appropriate borrowing era or even more).

- Complete online Access Guidance at the so you’re able to acquire federal finance.

Students have to have a totally free Application to own Federal Scholar Services (FAFSA) toward file, feel and make satisfactory educational improvements and become signed up for a minimum out-of half dozen (6) degree-applicable credit instances. Acceptance of this loan lies in the parent’s credit history.

A student have to have obtained its school funding prize current email address see just before submission a federal Head Including Application for the loan.

Excite consider the fresh new Government Lead As well as Application for the loan (on new School funding Versions webpage) for more information and you may app actions. More information from these types of funds can be acquired at the

Choice Funds

An alternative financing is an unsecured loan off a financial one is utilized to possess academic expenses. Really choice fund was deferrable if you do not graduate; even though some may require one to pay notice if you find yourself planning to college.

Alternative money exist as a supplementary methods to pay money for your college education. This type of financing usually are made use of since the a complement so you’re able to good student’s current financial aid bundle. Specific alternative fund are often used to pay money for prior balance to 1 year old. Youngsters exactly who belong to unsatisfactory educational advances also can get particular option financing to aid loans their education up to they get back to an excellent academic improvements and you will discovered federal educational funding once more.

It is in your favor becoming better-told before taking on obligations that are included with an enthusiastic informative financing. You should basic make an application for various other different school funding, also offers, grants, manager university fees payments, Head Stafford Finance, etc. before you apply to have a choice loan.

Become knowledgeable before you can borrow. Prior to taking out your option loan, keeps a clear knowledge of what sort of mortgage you have And its features, such as:

Installment may sound a country mile off, however, cautiously going for the alternative mortgage Today can indicate a less costly and more under control loan later on. Certain loan providers possess loans you to get into fees immediately following full disbursement. Some lenders bring applications that allow you have to pay digitally and offer advantages, for example lower interest rates, to people who continuously shell out on time. Information the choices will allow you to determine how far you can Riverside installment loans bad credit acquire.

Remember that these are funds, Perhaps not offers. When you get into repayment, you might be expected make monthly payments. Definitely dont lay yourself in a situation you don’t deal with.

According to the Higher education Chance Operate out-of 2008 (HEOA) and the Insights when you look at the Financing Operate (TILA), all private education lenders must obtain a done and you can finalized Thinking-Qualification Function (PDF) throughout the applicant ahead of handling an exclusive student loan.

College students can find the price of Attendance suggestions had a need to complete Point 2-A on the [Packing Financial aid link…] area of the School Collection.

The Mastrangelo Educational funding Heart can assist children which have achievement away from the form ahead of the college student entry it on the financial. Because mode is accomplished, children would be to discuss the status out-of individual student loan programs which have their financial truly.

Leave a Reply